Financial concerns have become a significant reality for Americans today, as many adults find themselves losing sleep over their monetary situations. Understanding the root causes of financial anxiety enables individuals to develop effective strategies and create a path toward financial stability.

Here are some things that may cause financial stress.

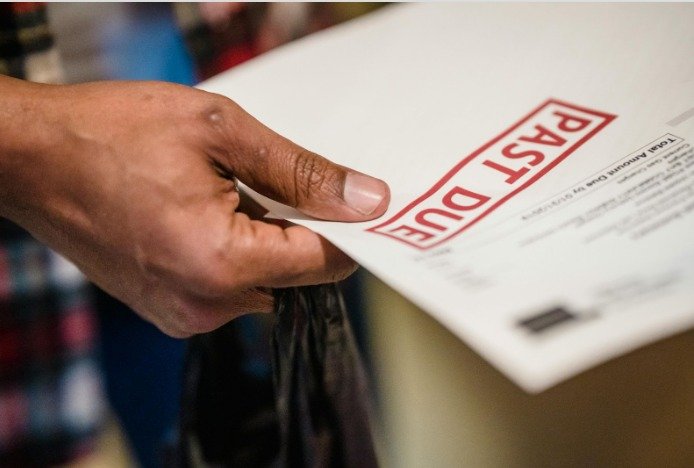

Unexpected Expenses and Emergency Situations

Many Americans struggle to handle unexpected expenses. These sudden financial burdens could create ripple effects that extend far beyond temporary budget constraints. When faced with unforeseen costs, individuals often find themselves making difficult choices between essential needs and urgent payments, leading to a cascade of monetary challenges. Natural disasters and accidents intensify these financial pressures, as families deplete their emergency reserves to cover insurance deductibles, temporary housing, and immediate repairs. The strain becomes particularly evident when multiple unexpected events occur in close succession, leaving households vulnerable to mounting debt. However, financial stability becomes more achievable through gradual implementation of protective measures. Building an emergency fund, maintaining adequate insurance coverage, and developing a flexible budget help create a financial safety net. Proactive approaches enable families to weather unexpected financial storms with greater resilience and maintain their long-term financial health.

Income Instability and Job Insecurity

The uncertainty of irregular income and employment security creates significant stress for many individuals. The economic downturn’s impact continues to resonate throughout the workforce, affecting countless Americans. Independent contractors and gig economy workers face unique challenges with unpredictable income streams. Workers in seasonal positions or commission-based roles might experience periods of financial uncertainty, making long-term financial planning particularly challenging. Staying hopeful and maybe even having structured approaches can be helpful to navigate these circumstances effectively.

Rising Cost of Living

The relentless rise in daily expenses creates mounting pressure on household budgets across the country. Housing costs have surged dramatically in recent years, consuming a larger share of family income than ever before. The burden of healthcare expenses weighs heavily on some households, with medical bills and insurance premiums potentially requiring substantial financial commitments. Essential items like groceries, utilities, and transportation now demand more of people’s monthly earnings, leaving less room for savings or discretionary spending. Families residing in urban centers may feel these financial strains more acutely, as city living often comes with premium prices for basic necessities. Many households find themselves making tough choices between equally important expenses, juggling priorities to maintain their standard of living.

Inadequate Financial Education

The lack of financial literacy continues to create significant monetary challenges for many individuals. People from all walks of life find themselves struggling with financial concepts. When someone doesn’t grasp essential money management principles, their decisions could lead to long-term financial consequences. Areas like budgeting, investing, retirement planning in Chandler, and handling debt require careful consideration and understanding. The complex world of personal finance can feel particularly daunting, with its array of investment vehicles and retirement planning options to navigate. Insurance products add another layer of complexity, leaving many individuals uncertain about which choices align with their financial goals. This uncertainty frequently results in missed opportunities for wealth building and financial security. Without a solid foundation in money management fundamentals, people may find themselves making decisions that compromise their long-term economic stability and limit their ability to achieve important life goals.

Societal Pressure and Lifestyle Inflation

Digital platforms often present carefully crafted images of luxurious lifestyles, creating relentless pressure to match what appears to be widespread success among peers. Many young workers find themselves stretching their monthly budgets far beyond comfortable limits, chasing the latest trends they encounter through various online channels. The combination of sophisticated marketing tactics makes it particularly challenging to maintain sensible spending habits. Anyone can fall into the trap of living beyond their means when bombarded with constant reminders of aspirational purchases and lifestyle choices. This pattern of excessive spending often leads to mounting financial anxiety, impacting both mental wellbeing and long-term financial stability. The cycle continues as more people feel compelled to maintain appearances through unsustainable purchasing decisions.

Conclusion

Many people may face financial challenges. You are not alone. Recognizing the root causes of financial stress is actually a powerful step toward regaining control of your financial well-being. Just keep being hopeful and know that this is a chapter that doesn’t have to last forever.